Investment Support

Airport Free Trade Zone (Logistics Complex)

The wings will pave the way for global business expansion.

There are no import and export customs clearance procedures, and special customs exemptions, VAT zero rates, and land rent reductions can be received.

The added value of logistics services increases through the synergy effect of national and international companies.

The added value of logistics services increases through the synergy effect of national and international companies.

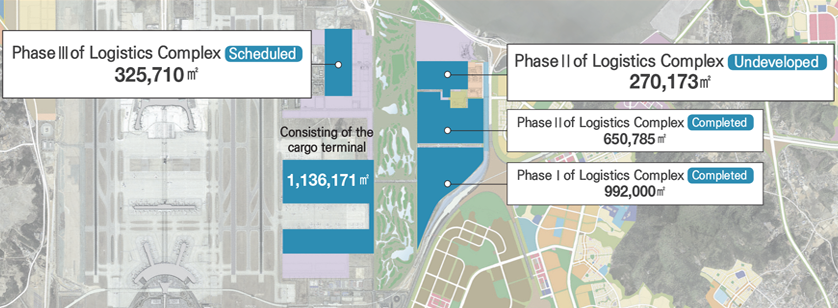

Development Plan

- Qualifications

- Manufacturing industry export purposes

- Foreign-invested companies in the manufacturing industry or knowledge service industry

- Knowledge Services Industry

- Wholesale business for import and export transactions

- Construction Conditions

- The logistics and manufacturing company's building land ratio is 70%, and the area ratio is 350%

- In compliance with obstacle restriction surface standards under the Airport Facilities Act

- Incheon International Airport Corporation Land Rent Reduction Benefits

- Prompt import and export without import and export customs clearance procedures (Paperless)

- Synergy can be created with global logistics companies that have already moved in

- Synergy effect by optimal location of the global delivery center and linkage with production bases

| Industry | investment amount | number of highest floors |

|---|---|---|

| Manufacturing Companies | USD 10 million or above: | 50% reduction for 3 years |

| USD 30 million or above: | 100% reduction for 5 years | |

| USD 50 million or above: | 100% reduction for 7 years | |

| Logistics company, *Global delivery center, development of logistics facilities, wholesale business | USD 5 million or above | 50% reduction for 3 years |

| USD 15 million or above | 100% reduction for 5 years | |

| USD 30 million or above | 100% reduction for 7 years |

Global delivery center: Refers to a facility that simply collects, stores, sorts, packs, and repairs cargo to promote manufacturing, logistics, distribution, etc., and must meet the following volume standards

| Customs Exemptions |

|

All production facilities/goods from overseas are duty-free |

| VAT zero rate applied |

|

Exemption from VAT on raw materials, machinery, etc. required for factory establishment |

Incheon International Airport Corporation

Incheon Free Economic Zone Authority